Up to 5% expected profit rate

Save in an Instant Access Saver with an expected rate

of up to 5% AER during November. T&Cs apply.

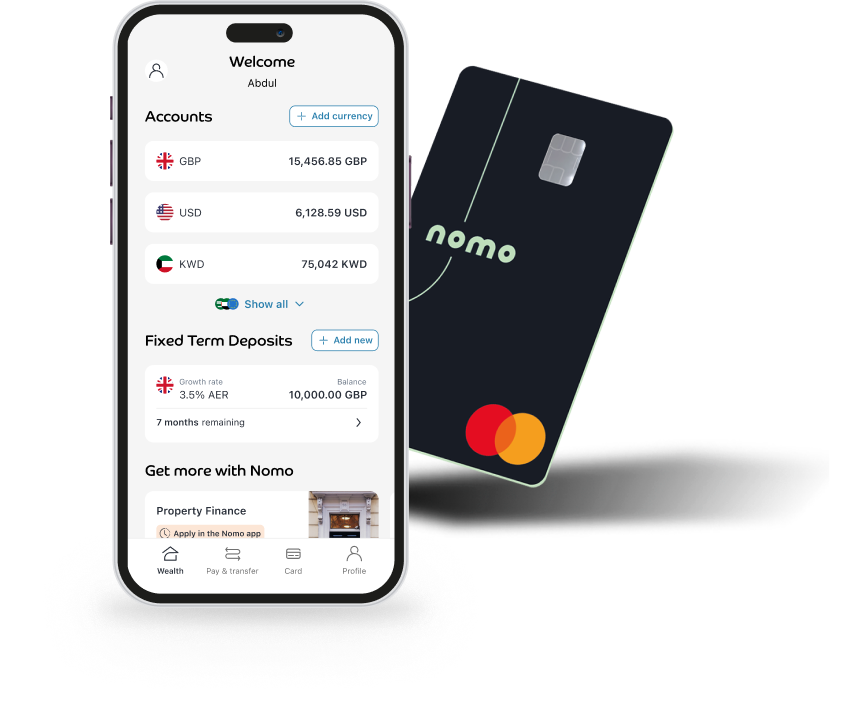

Banking solutions tailored to your international lifestyle

- Spend internationally in 6 different currencies with no fees

- Instant currency conversion through the app (GBP - USD - EUR - KWD - SAR - AED - INR)

- Free ATM cash withdrawals in the UK (ATM rates may apply)

- Free and instant transfers to other UK bank accounts

*Eligibility criteria apply. Nomo accounts are not currently available to UK residents.

Grow your wealth with UK investment opportunities

- Fixed-term and instant access savings accounts in GBP, USD, INR and Euro with competitive expected rates

- Property Finance for residential and rental properties in the UK**

- New international investment products coming soon!

**Your property may be at risk if you do not keep up the payments on your Nomo Property Finance

FAQ's test

Discover the answers to some commonly asked questions

Where do I apply from? test2

Download the ADCB | Nomo app from the App Store or Google Play. The application process can be completed from your smartphone.

What documents do I need to apply?

You need your physical passport and Emirates ID.

Secure banking

Your wealth is safeguarded with UK standard bank grade security.

FSCS protected test2

Deposits up to £85,880 test are covered by the FSCS protection scheme.

Sharia-compliant banking

Banking that’s open, clear and based on the principles of Islamic finance.